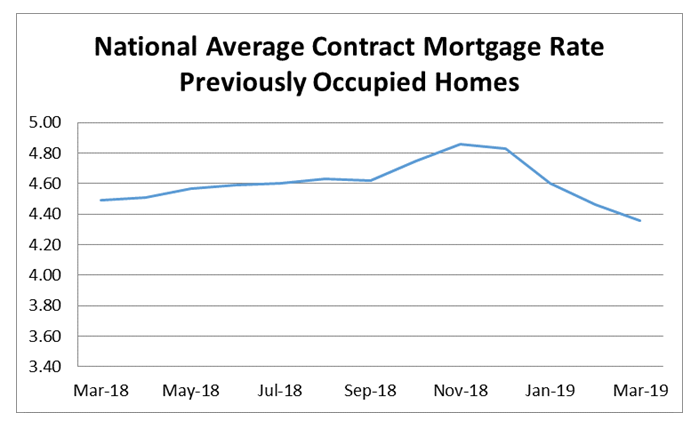

Nationally, interest rates on conventional purchase-money mortgages decreased from February to March, according to several indices of new mortgage contracts.

The National Average Contract Mortgage Rate for the Purchase of Previously Occupied Homes by Combined Lenders Index was 4.36 percent for loans closed in late March, down 10 basis points from 4.46 percent in February.

The average interest rate on all mortgage loans was 4.44 percent, down 6 basis points from 4.50 in February.

The average interest rate on conventional, 30-year, fixed-rate mortgages of $484,350 or less was 4.61 percent, down 6 basis points from 4.67 in February.

The effective interest rate on all mortgage loans was 4.51 percent in March, down 9 basis points from 4.60 in February. The effective interest rate accounts for the addition of initial fees and charges over the life of the mortgage.

The average loan amount for all loans was $325,100 in March, up $11,700 from $313,400 in February.

FHFA will release April index values Wednesday, May 29, 2019.

For more information, call David Roderer at (202) 649-3206. To hear recorded index information, call (202)649-3993. To find the complete contract rate series, go to https://www.fhfa.gov/DataTools/Downloads/Pages/Monthly-Interest-Rate-Data.aspx.

Source: FHFA

Technical note: The indices are based on a small monthly survey of mortgage lenders, which may not be representative. The sample is not a statistical sample but is rather a convenience sample. Survey respondents were asked to report terms and conditions of all conventional, single-family, fully amortized purchase-money loans closed during the last five working days of the month. Unless otherwise specified, the indices include 15-year mortgages and adjustable-rate mortgages. The indices do not include mortgages guaranteed or insured by either the Federal Housing Administration or the U.S. Department of Veterans Affairs. The indices also exclude refinancing loans and balloon loans. March 2019 values are based on 3,745 reported loans from 12 lenders, which include savings associations, mortgage companies, commercial banks, and mutual savings banks.