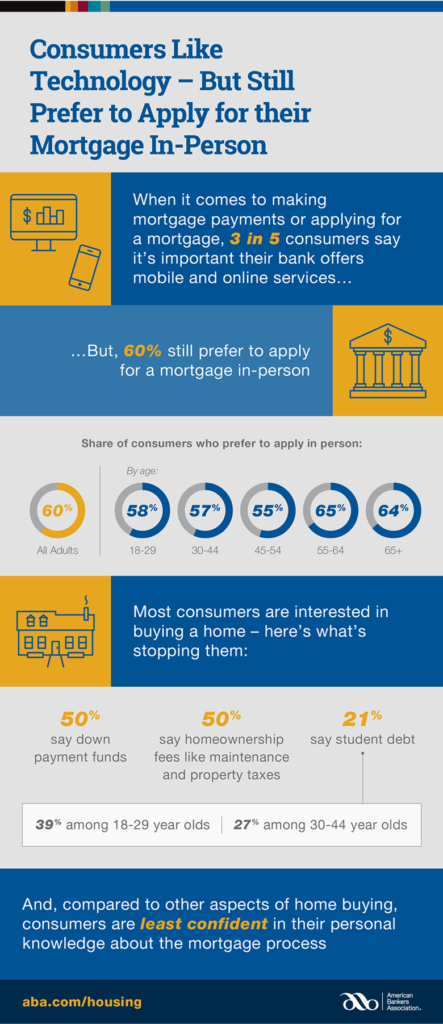

WASHINGTON — A majority of Americans (60 percent) agree that while they use online resources for research, they prefer to apply for a mortgage in person, according to a new survey from the American Bankers Association. Seventeen percent said they would prefer to apply for a mortgage online, while 23 percent were unsure.

“Banks invest billions of dollars to offer their customers the latest technology,” said Bob Davis, ABA executive vice president of mortgage markets, financial management and public policy. “But at the end of the day, nothing compares to sitting across the table, face-to-face with a banker when you’re making the single most important investment of your life.”

Consumers also indicated, though, that mobile or online services are important when it comes to obtaining a mortgage or making mortgage payments. Sixty-one percent of respondents consider mobile and online services very important or somewhat important, while 23 percent said they were not important.

“It’s no surprise that consumers want both technology and the in-person customer service they’ve become accustomed to,” said Davis.

The survey also found that the down payment and costs associated with homeownership are the biggest roadblocks to purchasing a home. Twenty-one percent of respondents said student debt is preventing them from purchasing a home. That number was higher among 18-29 year-olds at 39 percent.

According to the survey, consumers are least confident in their personal knowledge of the mortgage process. When asked to rate themselves, only 34 percent considered their knowledge about the process to be above average or excellent.

The online survey of 1,966 U.S. adults was conducted for ABA by Morning Consult May 25-30, 2017.